Graphene Plasmonics Engineering in 2025: Unleashing Next-Gen Photonic Devices and Sensing Breakthroughs. Explore How Advanced Materials Are Shaping the Future of Optoelectronics and Beyond.

- Executive Summary: Key Trends and Market Drivers in 2025

- Technology Overview: Fundamentals of Graphene Plasmonics

- Recent Breakthroughs and Patent Landscape

- Market Size and Forecasts: 2025–2030

- Key Applications: Photonics, Sensing, and Communications

- Competitive Landscape: Leading Companies and Innovators

- Manufacturing Challenges and Scalability

- Regulatory and Standardization Developments

- Strategic Partnerships and Investment Activity

- Future Outlook: Emerging Opportunities and Roadmap to 2030

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

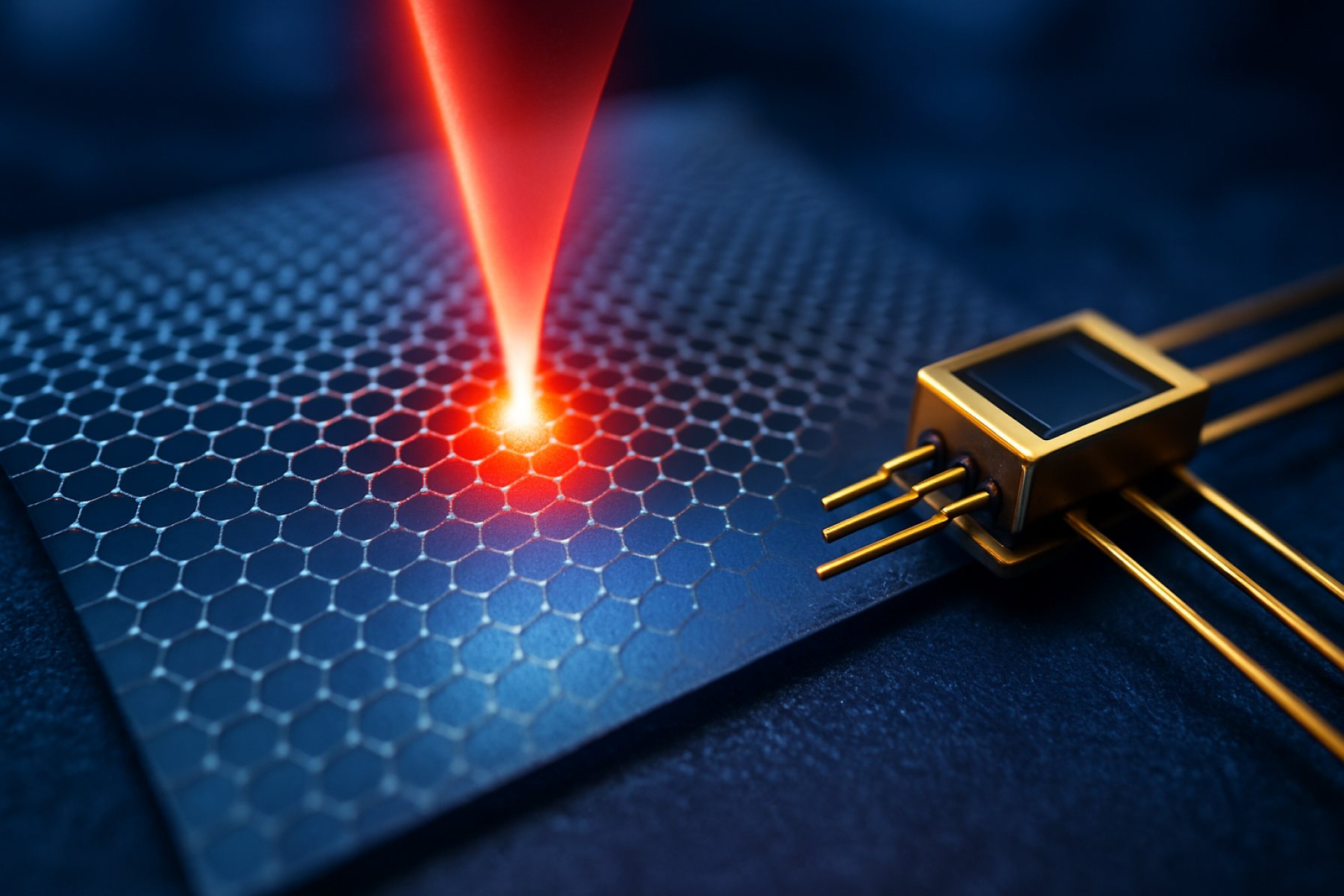

Graphene plasmonics engineering is poised for significant advancements in 2025, driven by the convergence of material innovation, device miniaturization, and expanding application domains. The unique ability of graphene to support highly tunable surface plasmons—collective oscillations of electrons—at terahertz to mid-infrared frequencies underpins its growing role in next-generation photonic and optoelectronic devices. Key trends shaping the sector include the maturation of large-area, high-quality graphene synthesis, integration with silicon photonics, and the emergence of commercial prototypes for sensing, communications, and energy applications.

A major driver is the progress in scalable graphene production. Companies such as Graphenea and Versarien have expanded their manufacturing capabilities, offering monolayer and multilayer graphene films suitable for plasmonic device fabrication. These materials are increasingly available with controlled doping and minimal defects, which are critical for reproducible plasmonic performance. The ability to produce wafer-scale graphene is enabling integration with established semiconductor processes, a key requirement for commercial adoption.

Device innovation is accelerating, with research and industry collaborations focusing on tunable plasmonic modulators, photodetectors, and biosensors. The integration of graphene with silicon and III-V photonics platforms is a notable trend, as it allows for the development of compact, energy-efficient components for optical communications and on-chip signal processing. Companies like AMS Technologies are actively involved in supplying advanced photonic components and supporting the transition from laboratory prototypes to market-ready devices.

In 2025, the demand for high-speed, low-loss optical interconnects in data centers and telecommunications is a significant market driver. Graphene plasmonic devices offer the potential for ultra-fast modulation and detection at frequencies beyond the reach of conventional materials. Additionally, the sensitivity of graphene plasmons to local environmental changes is spurring the development of next-generation biosensors and chemical detectors, with early-stage commercial interest from companies in the analytical instrumentation sector.

Looking ahead, the outlook for graphene plasmonics engineering is robust. Ongoing investments in material quality, device architecture, and system integration are expected to yield the first commercial deployments in specialized sensing and communications markets within the next few years. As manufacturing costs decrease and performance benchmarks are met, broader adoption in consumer electronics, medical diagnostics, and quantum technologies is anticipated, positioning graphene plasmonics as a cornerstone of future photonic innovation.

Technology Overview: Fundamentals of Graphene Plasmonics

Graphene plasmonics engineering is a rapidly advancing field that leverages the unique electronic and optical properties of graphene to manipulate plasmons—collective oscillations of free electrons—at the nanoscale. Unlike traditional plasmonic materials such as gold and silver, graphene offers tunable plasmonic resonances, high carrier mobility, and compatibility with flexible substrates, making it a promising candidate for next-generation photonic and optoelectronic devices.

In 2025, the focus of graphene plasmonics engineering is on optimizing the fabrication and integration of high-quality graphene with precise control over its electronic properties. Chemical vapor deposition (CVD) remains the dominant method for producing large-area, high-purity graphene films, with companies like Graphenea and First Graphene supplying materials tailored for plasmonic applications. These manufacturers are refining transfer techniques to minimize defects and contamination, which are critical for maintaining plasmonic performance.

Recent advances have demonstrated the ability to dynamically tune graphene plasmons via electrostatic gating, chemical doping, or hybridization with other two-dimensional materials. This tunability is a key differentiator, enabling devices such as modulators, sensors, and photodetectors that operate across a broad spectral range, from terahertz to mid-infrared. Research groups and industry partners are collaborating to integrate graphene plasmonic structures with silicon photonics platforms, aiming to enhance on-chip data transmission and sensing capabilities.

A significant milestone in 2024-2025 is the demonstration of wafer-scale graphene plasmonic devices with reproducible performance, paving the way for commercial adoption. Companies like Graphenea are actively involved in supplying materials for pilot production lines, while First Graphene is exploring scalable manufacturing routes for industrial applications. Additionally, AMBER (Advanced Materials and BioEngineering Research) is collaborating with industry to develop graphene-based plasmonic sensors for environmental and biomedical monitoring.

Looking ahead, the outlook for graphene plasmonics engineering is promising. The next few years are expected to see the emergence of integrated plasmonic circuits, advanced biosensors, and compact terahertz devices. Continued improvements in material quality, device architecture, and large-scale integration will be crucial for transitioning from laboratory prototypes to commercial products. As industry standards evolve and manufacturing processes mature, graphene plasmonics is poised to play a pivotal role in the future of photonics and optoelectronics.

Recent Breakthroughs and Patent Landscape

Graphene plasmonics engineering has witnessed significant breakthroughs in recent years, with 2025 marking a period of accelerated innovation and patent activity. The unique ability of graphene to support highly confined surface plasmons at terahertz to mid-infrared frequencies has driven both academic and industrial research, leading to new device concepts and commercial interest.

A major milestone in 2024 was the demonstration of tunable graphene plasmonic modulators and photodetectors with record-high responsivity and speed, enabled by advances in large-area, high-mobility graphene synthesis. Companies such as Graphenea and First Graphene have played pivotal roles by supplying high-quality graphene films and developing scalable transfer techniques, which are essential for integrating graphene with photonic and electronic platforms. These advances have allowed for the fabrication of wafer-scale graphene plasmonic devices, a key requirement for commercial deployment in telecommunications and sensing.

On the patent front, there has been a marked increase in filings related to graphene-based plasmonic waveguides, modulators, and biosensors. IBM and Samsung Electronics have expanded their intellectual property portfolios, focusing on hybrid graphene-metal plasmonic structures and tunable optoelectronic components. Notably, IBM has disclosed methods for integrating graphene plasmonic elements with silicon photonics, aiming to enhance data transmission rates and energy efficiency in data centers. Meanwhile, Samsung Electronics has filed patents on graphene plasmonic sensors for next-generation mobile and wearable devices, targeting applications in health monitoring and environmental detection.

European research consortia, supported by the Graphene Flagship, have also contributed to the patent landscape, particularly in the area of mid-infrared graphene plasmonic biosensors and on-chip spectroscopy. These efforts are complemented by collaborations with industrial partners to accelerate technology transfer and standardization.

Looking ahead to the next few years, the outlook for graphene plasmonics engineering is robust. The convergence of scalable graphene manufacturing, maturing device architectures, and a dynamic patent environment is expected to drive the commercialization of graphene plasmonic components in optical communications, medical diagnostics, and security. As intellectual property positions solidify, leading suppliers such as Graphenea and First Graphene are poised to benefit from licensing and supply agreements, while technology giants like IBM and Samsung Electronics are likely to accelerate product development cycles leveraging their patent portfolios.

Market Size and Forecasts: 2025–2030

The market for graphene plasmonics engineering is poised for significant growth between 2025 and 2030, driven by advances in nanofabrication, optoelectronics, and the increasing demand for high-speed, miniaturized photonic devices. As of 2025, the sector remains in an early commercialization phase, with a handful of pioneering companies and research institutions transitioning laboratory-scale breakthroughs into scalable products. The unique ability of graphene to support tunable surface plasmons in the terahertz to mid-infrared range underpins its appeal for next-generation sensors, modulators, and photodetectors.

Key industry players such as Graphenea and Directa Plus are actively expanding their graphene material portfolios, targeting applications in photonics and plasmonics. Graphenea, for example, supplies high-quality graphene films and devices, supporting both academic and industrial R&D in plasmonic device prototyping. Meanwhile, Directa Plus is investing in scalable production methods for graphene-based materials, which are critical for the cost-effective manufacturing of plasmonic components.

The market outlook for 2025–2030 is shaped by several factors:

- Telecommunications and Data Processing: The integration of graphene plasmonic modulators and photodetectors into optical communication systems is expected to accelerate, as these devices offer ultra-fast response times and broad spectral tunability. Industry collaborations with telecom equipment manufacturers are anticipated to drive early adoption.

- Sensing and Imaging: Graphene plasmonic sensors, with their high sensitivity and selectivity, are being developed for environmental monitoring, medical diagnostics, and security applications. Companies are working to meet the stringent reliability and reproducibility standards required for commercial deployment.

- Manufacturing Scale-Up: The transition from prototype to mass production remains a challenge. However, investments in roll-to-roll graphene synthesis and advanced lithography are expected to reduce costs and improve device yields by the late 2020s.

By 2030, the graphene plasmonics engineering market is projected to reach a multi-billion-dollar valuation, with the Asia-Pacific region—particularly China, South Korea, and Japan—emerging as major hubs for both manufacturing and end-use applications. The European Union’s continued funding of graphene flagship projects and the involvement of companies like Graphenea are expected to sustain innovation and commercialization momentum. Overall, the next five years will be critical in establishing graphene plasmonics as a foundational technology in photonics and optoelectronics.

Key Applications: Photonics, Sensing, and Communications

Graphene plasmonics engineering is rapidly advancing as a transformative approach in photonics, sensing, and communications, leveraging the unique ability of graphene to support highly tunable surface plasmons in the terahertz to mid-infrared spectral range. In 2025, the field is witnessing a convergence of material innovation, device integration, and commercial interest, with several key players and research institutions pushing the boundaries of what is possible.

In photonics, graphene plasmonic structures are being engineered to enable ultra-compact modulators, photodetectors, and light sources. The exceptional confinement and tunability of graphene plasmons allow for devices with footprints orders of magnitude smaller than those based on conventional materials. Companies such as Graphenea and Graphene Platform Corporation are supplying high-quality graphene and collaborating with photonics manufacturers to integrate graphene into silicon photonics platforms. This integration is expected to yield faster, more energy-efficient optical interconnects for data centers and next-generation computing systems.

In the realm of sensing, graphene plasmonics is enabling highly sensitive detection of biomolecules, gases, and environmental pollutants. The strong field enhancement near graphene nanostructures amplifies molecular signatures, making it possible to detect trace amounts of analytes. Graphenea and First Graphene are actively developing graphene-based substrates and sensor components, targeting applications in medical diagnostics and industrial monitoring. The ability to dynamically tune the plasmonic response via electrical gating or chemical functionalization is a key advantage, allowing for multiplexed and reconfigurable sensor arrays.

Communications technologies are also set to benefit from graphene plasmonics, particularly in the development of modulators and switches operating at terahertz frequencies. The high carrier mobility and broadband optical response of graphene make it an ideal candidate for ultrafast, low-loss signal processing components. Graphene Platform Corporation and Graphenea are collaborating with telecom equipment manufacturers to prototype graphene-based modulators and photodetectors, with pilot deployments anticipated in the next few years.

Looking ahead, the outlook for graphene plasmonics engineering is highly promising. As fabrication techniques mature and large-area, high-quality graphene becomes more accessible, the commercialization of graphene plasmonic devices in photonics, sensing, and communications is expected to accelerate. Industry partnerships and government-backed initiatives are fostering a robust ecosystem, positioning graphene plasmonics as a cornerstone technology for the next generation of optoelectronic systems.

Competitive Landscape: Leading Companies and Innovators

The competitive landscape of graphene plasmonics engineering in 2025 is characterized by a dynamic interplay between established material manufacturers, innovative startups, and research-driven technology firms. The field, which leverages the unique plasmonic properties of graphene for applications in photonics, sensing, and optoelectronics, is witnessing accelerated commercialization as fabrication techniques mature and integration with existing semiconductor processes improves.

Among the leading players, Graphenea stands out as a prominent supplier of high-quality graphene materials, including monolayer and multilayer films suitable for plasmonic device fabrication. The company has expanded its product portfolio to include custom graphene-on-substrate solutions, catering to the specific needs of plasmonics researchers and device manufacturers. Their collaborations with academic and industrial partners have enabled the development of prototype plasmonic modulators and photodetectors, with pilot-scale production anticipated in the near term.

Another key innovator is 2D Semiconductors, which specializes in the synthesis of atomically thin materials, including graphene and transition metal dichalcogenides (TMDs). Their expertise in wafer-scale growth and transfer processes is critical for the scalable manufacturing of graphene plasmonic components, particularly for integration into silicon photonics platforms. The company’s recent investments in automated production lines are expected to reduce costs and improve uniformity, addressing two major barriers to widespread adoption.

On the device integration front, AMS Technologies is actively developing photonic and optoelectronic systems that incorporate graphene-based plasmonic elements. Their focus is on high-speed optical modulators and sensors for telecommunications and biosensing, leveraging graphene’s tunable plasmonic response in the mid-infrared and terahertz regimes. AMS Technologies’ partnerships with European research consortia are accelerating the transition from laboratory prototypes to market-ready products.

In Asia, First Graphene is investing in advanced graphene production and functionalization techniques, targeting applications in energy, electronics, and photonics. Their R&D efforts include the development of graphene inks and coatings optimized for plasmonic resonance, with pilot projects underway in collaboration with regional universities and technology institutes.

Looking ahead, the competitive landscape is expected to intensify as more companies enter the market and as standardization efforts progress. The next few years will likely see increased collaboration between material suppliers, device manufacturers, and end-users, driving innovation in device architectures and accelerating the commercialization of graphene plasmonic technologies across telecommunications, sensing, and quantum information sectors.

Manufacturing Challenges and Scalability

Graphene plasmonics engineering, which leverages the unique optical and electronic properties of graphene for manipulating light at the nanoscale, is rapidly advancing toward commercial relevance. However, the transition from laboratory-scale demonstrations to industrial-scale manufacturing faces significant challenges, particularly in the areas of material quality, device integration, and cost-effective scalability.

A primary challenge is the synthesis of high-quality, large-area graphene with minimal defects and uniform thickness. Chemical vapor deposition (CVD) remains the most widely adopted method for producing wafer-scale graphene films, but issues such as grain boundaries, wrinkles, and contamination during transfer processes can degrade plasmonic performance. Companies like Graphenea and 2D Semiconductors are at the forefront of refining CVD techniques, offering monolayer and multilayer graphene on various substrates. These suppliers are investing in improved roll-to-roll and batch processing methods to enhance throughput and reproducibility, which are critical for scaling up device fabrication.

Another bottleneck is the integration of graphene with photonic and electronic platforms. Plasmonic devices often require precise patterning of graphene at the nanoscale, typically achieved through electron-beam lithography or advanced nanoimprint techniques. The scalability of these processes is limited by throughput and cost. Efforts are underway to develop scalable photolithography and direct laser writing methods, with companies such as Oxford Instruments providing advanced etching and deposition equipment tailored for 2D materials processing.

Material uniformity and device yield are also critical for commercial viability. Variations in graphene quality across large wafers can lead to inconsistent plasmonic responses, impacting device performance. To address this, industry players are investing in in-line metrology and quality control systems. For example, Renishaw offers Raman spectroscopy solutions for real-time monitoring of graphene quality during production, enabling tighter process control.

Looking ahead to 2025 and beyond, the outlook for scalable graphene plasmonics manufacturing is cautiously optimistic. The convergence of improved CVD growth, automated transfer, and scalable patterning technologies is expected to enable pilot-scale production of graphene-based plasmonic components for applications in sensing, communications, and optoelectronics. However, further progress will depend on continued collaboration between material suppliers, equipment manufacturers, and end-users to standardize processes and drive down costs. As the ecosystem matures, the role of established suppliers such as Graphenea and 2D Semiconductors will be pivotal in bridging the gap between research and industrial adoption.

Regulatory and Standardization Developments

The regulatory and standardization landscape for graphene plasmonics engineering is evolving rapidly as the field matures and moves closer to commercial applications. In 2025, the focus is on establishing clear guidelines for material quality, device performance, and safety, which are essential for the integration of graphene-based plasmonic components into mainstream photonic and optoelectronic systems.

A key development is the ongoing work by the International Organization for Standardization (ISO), which has been actively developing standards for graphene materials, including nomenclature, characterization methods, and quality metrics. The ISO/TC 229 Nanotechnologies committee, in collaboration with industry stakeholders, is expected to release updated standards specifically addressing the unique requirements of graphene plasmonic materials, such as surface plasmon resonance properties and optical conductivity benchmarks. These standards aim to harmonize testing protocols and facilitate cross-border trade and collaboration.

In parallel, the European Committee for Standardization (CEN) and the European Committee for Electrotechnical Standardization (CENELEC) are working on guidelines for the safe handling and integration of graphene in photonic devices, with a particular emphasis on workplace safety and environmental impact. These efforts are supported by the Graphene Flagship, a major European initiative that brings together academic and industrial partners to accelerate the commercialization of graphene technologies. The Flagship is actively involved in pre-normative research and the development of best practices for the fabrication and testing of graphene plasmonic devices.

On the regulatory front, agencies such as the U.S. Environmental Protection Agency (EPA) and the French Agency for Food, Environmental and Occupational Health & Safety (ANSES) are monitoring the potential health and environmental risks associated with the production and use of graphene-based materials. In 2025, these agencies are expected to issue updated guidance on exposure limits and waste management protocols for nanomaterials, including those used in plasmonic applications.

Looking ahead, the next few years will likely see increased coordination between international standards bodies and regulatory agencies to address emerging challenges, such as the scalability of graphene plasmonic device manufacturing and the traceability of material properties throughout the supply chain. Industry leaders, including Graphenea and Versarien, are anticipated to play a significant role in shaping these frameworks by providing feedback from pilot production lines and early commercial deployments. The establishment of robust standards and regulatory clarity is expected to accelerate the adoption of graphene plasmonics in sectors such as telecommunications, sensing, and medical diagnostics.

Strategic Partnerships and Investment Activity

The landscape of graphene plasmonics engineering in 2025 is characterized by a surge in strategic partnerships and targeted investment, as both established industry players and innovative startups seek to capitalize on the unique optical and electronic properties of graphene. The drive to commercialize graphene-based plasmonic devices—ranging from ultra-fast photodetectors to tunable optical modulators and advanced sensors—has led to a notable increase in collaborative ventures between material suppliers, device manufacturers, and research institutions.

One of the most prominent examples is the ongoing collaboration between Graphenea, a leading European graphene producer, and several photonics and semiconductor companies. Graphenea has established itself as a key supplier of high-quality graphene films and devices, supporting joint development projects aimed at integrating graphene plasmonic components into next-generation optoelectronic platforms. These partnerships are often supported by European Union innovation programs, which continue to provide significant funding for graphene research and commercialization.

In Asia, First Graphene Limited has expanded its strategic alliances with electronics manufacturers and research consortia, focusing on the scalable production of graphene materials tailored for plasmonic and photonic applications. The company’s efforts are directed at enabling mass-market adoption of graphene-enhanced devices, particularly in telecommunications and sensing, where plasmonic effects can dramatically improve performance.

Meanwhile, in North America, Versarien plc and Nano-C, Inc. are actively engaging in joint ventures and licensing agreements to accelerate the integration of graphene into commercial plasmonic devices. These companies are leveraging their proprietary production technologies and intellectual property portfolios to attract investment from both private equity and strategic corporate partners, with a focus on applications in data communications and medical diagnostics.

Investment activity in 2025 is also being shaped by the entry of major semiconductor and photonics companies into the graphene plasmonics space. These firms are increasingly seeking partnerships with specialized graphene producers to secure reliable supply chains and co-develop application-specific materials. The trend is further reinforced by government-backed initiatives in the US, EU, and Asia, which are channeling resources into pilot manufacturing lines and demonstration projects.

Looking ahead, the outlook for strategic partnerships and investment in graphene plasmonics engineering remains robust. As device performance benchmarks are met and manufacturing processes mature, the sector is expected to see further consolidation, with leading material suppliers and device integrators forming deeper alliances to accelerate commercialization. The next few years will likely witness the emergence of vertically integrated value chains, positioning graphene plasmonics as a cornerstone technology in advanced photonics and optoelectronics.

Future Outlook: Emerging Opportunities and Roadmap to 2030

Graphene plasmonics engineering is poised for significant advancements through 2025 and into the latter half of the decade, driven by the convergence of material innovation, device miniaturization, and the growing demand for high-speed, energy-efficient photonic and optoelectronic components. The unique ability of graphene to support highly confined, tunable surface plasmons in the terahertz to mid-infrared range underpins its appeal for next-generation applications in sensing, communications, and quantum technologies.

In 2025, the field is expected to benefit from improved large-area, high-quality graphene synthesis methods, with companies such as Graphenea and 2D Semiconductors supplying monolayer and multilayer graphene tailored for plasmonic device fabrication. These suppliers are scaling up production to meet the needs of both research and early-stage commercial applications, including photodetectors, modulators, and biosensors. The integration of graphene with silicon photonics platforms is a key focus, as it enables the development of compact, CMOS-compatible plasmonic circuits for data centers and telecommunications.

Recent demonstrations of graphene-based plasmonic modulators and photodetectors have shown modulation speeds exceeding 100 GHz and responsivities surpassing those of traditional materials, indicating strong commercial potential. For example, AMBER Centre and its partners are actively developing graphene plasmonic components for on-chip optical interconnects and mid-infrared spectroscopy, targeting applications in environmental monitoring and medical diagnostics.

Looking ahead, the roadmap to 2030 envisions the emergence of hybrid plasmonic systems, where graphene is combined with other two-dimensional materials (such as transition metal dichalcogenides) or integrated with metasurfaces to achieve unprecedented control over light-matter interactions. This will enable ultra-sensitive biosensors, tunable infrared sources, and compact quantum photonic devices. Industry consortia and standardization bodies, including the Graphene Flagship, are coordinating efforts to address challenges in device reproducibility, scalability, and system integration.

- By 2027, commercial deployment of graphene plasmonic sensors in medical diagnostics and environmental monitoring is anticipated, leveraging their high sensitivity and selectivity.

- By 2030, graphene plasmonic modulators and photodetectors are expected to be integral to high-speed optical communication systems, with ongoing improvements in fabrication yield and device performance.

- Collaborations between material suppliers, device manufacturers, and end-users will be critical to accelerate the transition from laboratory prototypes to market-ready products.

Overall, the next five years will be pivotal for graphene plasmonics engineering, as advances in material quality, device architecture, and system integration converge to unlock new commercial opportunities and establish a foundation for the photonic technologies of the next decade.

Sources & References

- Versarien

- AMS Technologies

- First Graphene

- IBM

- Graphene Flagship

- Directa Plus

- Graphene Platform Corporation

- 2D Semiconductors

- Oxford Instruments

- Renishaw

- International Organization for Standardization

- European Committee for Standardization

- European Committee for Electrotechnical Standardization

- French Agency for Food, Environmental and Occupational Health & Safety

- Nano-C, Inc.